Klimt Cairnhill 康邻豪庭

- Klimt Cairnhill is crowned as a freehold legacy for the next Generation.- An ultra-luxurious 138 units situated along the prestigious Cairnhil Road.

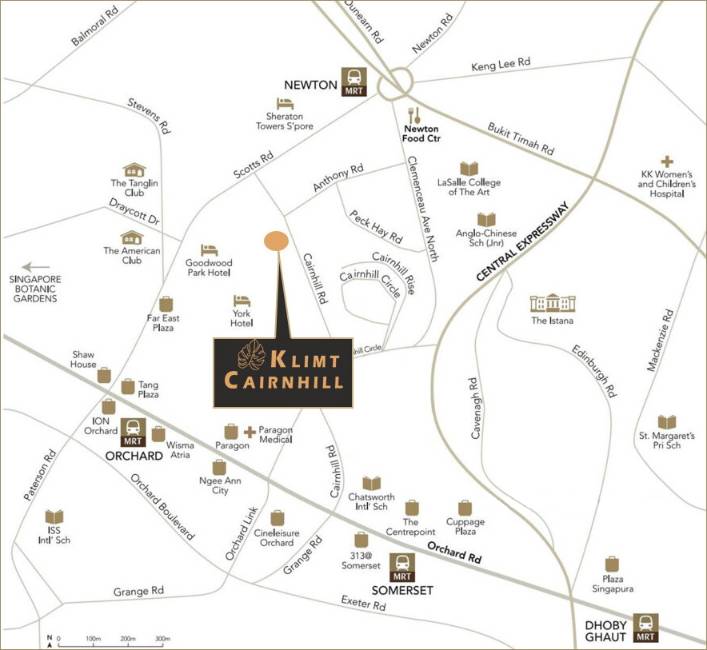

- With just minutes to Orchard Road Shopping Belt and Newton MRT Station, it is the ideal place for working professionals.

- This condo is also located near prestigious schools, premier private clubs and luxury hotels.

Schedule Viewing Appointment

Latest News

LAST UPDATED: Tuesday 23 Apr 2024

23 Apr 2024 | Schedule an Online Appointment with me for a Personalised Virtual Tour of Klimt Cairnhill 康邻豪庭!

18 Apr 2024 | Wish to know the exact location for the project?

13 Apr 2024 | Register with us to receive latest Site plan & floor plan

03 Apr 2024 | Contact our Klimt Cairnhill 康邻豪庭 developer appointment sales team hotline (+6594312124) for further assistance

24 Mar 2024 | Welcome to Klimt Cairnhill 康邻豪庭 site!

Klimt Cairnhill 康邻豪庭

Klimt Cairnhill Condo is in the former Cairnhill Mansions enbloc that is up for collective sale last year. The development is located at District 09 Cairnhill Road and is located in one of the most prestigious residential location in Singapore. Klimt Cairnhill promises a bouquet of facilities carefully planted throughout the development. From vibrant pools and playgrounds teeming with life to calming gardens and lounges, each offers an oasis of respite.

Read More

Units138 units

TypeResidential Highrise

DistrictD09 - Orchard / River Valley

Tenure Freehold

Location

Located in District 9, Orchard, Klimt Cairnhill is at the center of Singapore. There is an abundance of amenities and the neighbourhood of Cairnhill Road enjoys the tranquillity, the paranomic city views of Orchard city as well as the Somerset shopping area. Klimt Cairnhill location presents an incredible opportunity for owners who would want to retire from busy working life and get home in the heart of the city. The development is the perfect place to relax to read a book among others after a busy day at work. Together with the amenities offered by the development as well as the complete range of eateries and restaurants, residents of Klimt Cairnhill location will get their daily necessities with no effort at all.

Read More

Quick links

Gallery

Register Your Interest

Book an appointment to view show flat or send us an inquiry. We will get back to you as soon as possible.

.jpeg)

.jpeg)